Continuous close: what is it, and how can it benefit your business?

The business environment today is fast-paced and characterised by dynamic unpredictability. Such circumstances call for finance and accounting leaders to produce crucial business intelligence faster and more efficiently to inform strategic decision-making.

As companies deal with the urgency demanded by this new landscape, there is growing obsolescence in the traditional closing process. It’s a known pain point for many financial teams, often involving at least five days of intense work. However, ‘closing the books’ is an essential business operation; it’s time to make it more efficient.

A traditional way to close

In finance and accounting, ‘close’ refers to the financial reporting at the end of a specified financial period. Conducted every month, quarter or year, it’s often a time-consuming process that typically features:

- Systems and data, including distributed systems and maintenance metadata;

- Processes, which are linear and follow rigorous timings, but present numerous challenges in planning, budgeting and intercompany reconciliations;

- Analytics, following a wide range of Generally Accepted Accounting Principles and/or Charts of Accounts but providing limited forecasting capabilities; and

- Organisation, characterised by lengthy decision-making workflows.

It’s a process that closely mirrors the fiscal calendar, and the traditional model involves a series of laborious steps:

- Creating financial records

- Performing financial accounting

- Performing financial closing (at least two days)

- Performing financial reporting (at least three days)

Importantly, such financial reports can often be the first time many executives see data that could be critical in financial and strategic planning.

Challenges of the traditional financial close process

For many years the benchmark for traditional monthly closing has been six business days. However, this often isn’t the case in practice; a 2022 study by Ventana Research found that only 53% of companies complete their monthly close in six days, with the number dropping to 40% for quarterly closes. In 62% of companies, slower close cycles can be attributed to a failure to automate reconciliations; the increasing complexity of business operations and the number of regulations to follow come a close second.

Other challenges of the traditional monthly approach include:

- Lack of clarity as data and processes become jumbled and hard to track

- More opportunities for error

- Time-consuming, as organisations spend more time tracking and fixing errors

- Lags in accessing vital business information for decision-making.

So many businesses are shifting from the traditional, month-end close process to faster, more efficient alternatives.

Continuous close: why choose it?

The continuous close, which leverages automation and system integration to allow users to make entries immediately,is one of the models that’s replacing traditional methods. Continuous closing allows for instant vision of the current state of your organisation’s accounts at any point in the reporting cycle. It also permits a close at any point, with the main objectives being two-fold:

- Access to real-time business intelligence from transaction data that has gone through instantaneous consolidation and reconciliation.

- Automated forecasts, allowing you to keep your monthly account balance predictable.

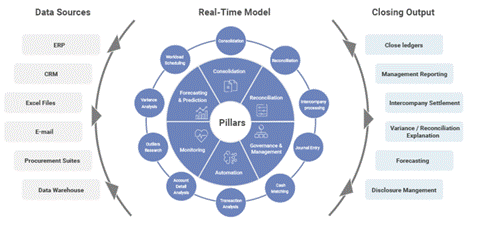

To achieve these goals effectively, a real-time continuous close process must be designed around several distinct pillars that facilitate a steady stream of accessible data and provide a holistic accounting overview:

NTT DATA’s model for a seamlessly efficient continuous close process addresses six main elements of the central pillars outlined above:

The model provides integrated information across previously siloed systems and data sets, providing a top-down model that eliminates spreadsheets and allows for whole-process follow-up. It gives users greater control over role analysis and shortens response times across the organisation.

Furthermore, built-in analytics capabilities – adapted to your specific business needs – leverage predictive analysis to inform strategy and provide immediate updates on demand.

Benefits of continuous close

Continuous close converts closing from a laborious process of accounting to a valuable strategic tool, providing demonstrable results and a comprehensive, real-time overview of your current financial status.

Prepare financial statements with more agility in less time, with fewer errors and less reliance on spreadsheets; data shows that companies using spreadsheets typically take almost eight business days to close. NTT DATA’s model reduces the time spent on closing by 30–40% and offers automated close estimates.

- Better decision-making

The continuous close process puts essential business insights at your fingertips. Access valuable data earlier to facilitate quicker, high-level forecasting and start making more effective, data-driven decisions for your company.

● High-quality data in real time

Continuous close grants you greater visibility over your accounts and operations through its unified data-sharing approach. By ensuring that your books are always up to date, you can prepare financial statements that are more accurate, credible and valuable in your strategic decision-making process.

Automating your systems will lead to fewer errors and greater transparency, making it easier to comply with the regulatory requirements in force in your sector.

At NTT DATA, we have years of experience empowering organisations to create an integrated ecosystem that streamlines their processes and unifies siloed systems and data, analytics and operations. Talk to us to find out how we can help your business move to continuous close.

Head of Digital Transformation – Finance at NTT DATA

Business Consulting Manager – Finance at NTT DATA