Eight keys to keeping your finance function fit for purpose in uncertain times

Recent macro trends have created a challenging operating environment for businesses in almost every sector. Among these is the COVID–19 epidemic which, though it may seem well behind us, has changed the face of work, with hybrid or fully remote working now the norm. Global geopolitical instability also continues to negatively impact supply chains worldwide.

Additionally, disruptive emerging technologies like artificial intelligence (AI) are sparking transformation in an economic landscape characterised by high inflation and a cost of living crisis. The market is changing too; this is an era of connected consumers who prioritise sustainability, reject greenwashing, and expect the companies they engage with to align with their values. While this combination drives up business expenses, it makes it harder to transfer those rising costs to customers.

Rethinking objectives

These scenarios are most likely to affect the customer-facing side of any company, but their impact on back-office operations such as finance should not be underestimated. Corporate functions that are unseen by clients also have to reframe their objectives if they are to continue delivering value. This can be achieved by focusing on two principal areas:

- Maximising efficiency in the transactional activities that, while essential for a company’s well-being, do not translate to differential value or visible cost differences; and

- Facilitating informed strategic decision-making by generating and reporting timely, accurate financial and non-financial data.

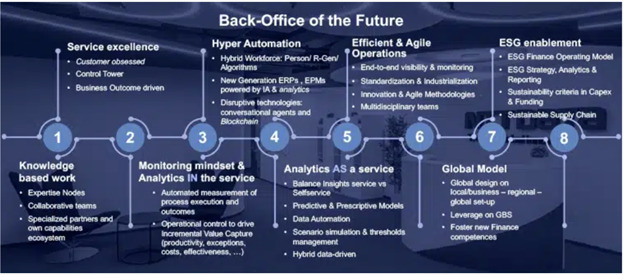

What should a modern back office look like?

Smooth, cost-effective finance and accounting operations require a new structure that addresses both current and anticipated needs while delivering efficiency and valuable business intelligence. Future finance teams will likely have fewer professionals; however, they’ll be more proficient in data, ready to forecast business needs and extract actionable insights that can inform strategic thinking.

Wherever they’re working, these professionals will need the support of a network of expertise that’s not just human. They’ll leverage the capabilities of automation, AI-powered virtual assistants and bots, and algorithms—ideally founded on a single platform—to deliver seamless excellence.

Critical levers for evolution

At NTT DATA, we have identified eight key elements that will define the successful finance department of the future. By implementing them, your team will develop their capacity to provide back-office services fit for the demands of the evolving business ecosystem:

Structured, not reactive service

Deliver high-quality work based on demand management through predefined and scheduled deliverables. In such a ‘self-service’ model, key performance indicators will also be set and service-level agreements defined. NTT DATA secured a 20% increase in productivity at a major manufacturing firm by establishing a calendar for some 70% of their final deliverables with this model.

Knowledge-based teams

Ensure that back-office functions are carried out by experts with the knowledge and specialised expertise to anticipate the company’s needs and collaborate with other business units to fulfil them.

Hyper automation

Automate recurring, repetitive tasks in administration and the finance department as far as possible through modern, transversal ERP solutions and AI-powered bots. If best practices in EPM and analytics are adhered to, as much as 90% of such tasks can be automated, freeing up your expert team to work on matters that add value to the organisation.

AI and GenAI

Artificial intelligence is already in widespread use in the finance function for forecasting and planning, regulatory compliance, task automation, cash-flow optimisation and managing employees’ expenses. And as financial departments’ understanding of the tools grows, AI and GenAI will feature increasingly prominently in more complex analysis and strategic decision-making, not to mention the fundamental role it will play in the online security battleground.

Continuous monitoring and analytics

Organisations can enhance service delivery significantly and pinpoint new ways to capture value by automating recurring business processes. However, it’s vital to monitor their implementation to ensure success. NTT DATA secured €70 million in capital savings for a leading pharmaceuticals multinational by leveraging process mining to improve over-the-counter services.

Make operations agile and efficient

Agile work methodologies can produce impactful results not just in the Business-As-Usual metrics, but in a finance department’s transformational tasks. However, this is only true provided their specific needs are respected, such as leaving sufficient time for month-end accounting tasks.

NTT DATA secured 10% productivity increases for a major corporation in the telecommunications sector by setting up a more ‘liquid’ organisational model; non-specialist functions like Procure-to-Pay and Record-to-Report were shared among different areas of the finance team.

Harness the power of advanced analytics

Cutting-edge predictive and prescriptive analytics deliver results quickly, allowing more time for analysis. This, in turn, informs strategic decision-making and even simulates the results of various scenarios and actions. In the tech sector, a leading organisation automated its rolling forecast process, increasing its accuracy to over 96% and reducing the number of people working on the function from 150 to five.

Build ESG into the finance function

The right solution will incorporate your business’s sustainability into the finance department’s functions. It will also help ESG metrics gain traction by reporting on non-financial data both internally and to the market. Through this model, it becomes easy to align your organisation’s ESG vision with its corporate strategy and day-to-day operations. Furthermore, by integrating sustainability into Capital Expenditure, ESG objectives are much more achievable in the medium-to-long term.

Toward a global model

A single solution, tailored to your finance department’s needs and operating from a single source of truth, builds in the regional and global vision your team requires. Their capabilities will be expanded, service-delivery timescales are shortened, and each member’s specific expertise can be diverted to more strategically imperative activities.

Redefine your finance team with NTT DATA

From building a conceptual framework customised to your finance team’s needs, to development, deployment and post-rollout support, NTT DATA provides an end-to-end service to prepare finance departments for today’s and tomorrow’s business realities. Talk to us to find out what we can do for your organisation.

Director at NTT DATA Digital Finance